Comprehensive Guide To Feasibility Study Cost Evaluation For Profitable Projects

Feasibility study cost revealed evaluates the viability of a project by assessing its financial feasibility. The study examines costs, potential benefits, cash flow, funding sources, and expenses to determine the project’s profitability. It includes fixed costs (e.g., rent, salaries), operating costs (e.g., insurance, utilities), production costs (e.g., direct material, labor), and variable costs (e.g., raw materials). By conducting a comprehensive analysis, the study reveals the total cost, profitability, and overall financial position of the project, helping investors make informed decisions.

Understanding Feasibility Studies: The Foundation for Financial Success

- Define feasibility studies and their significance in assessing project viability.

Understanding Feasibility Studies: The Foundation for Financial Success

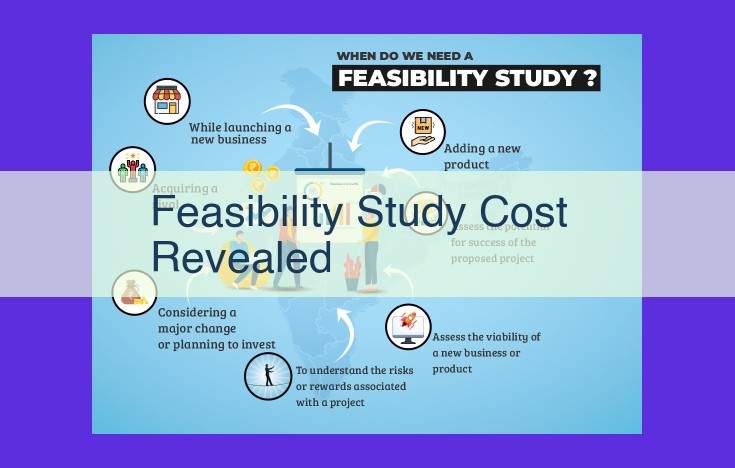

In the realm of business and investment, a feasibility study is like a trusted guide, illuminating the path to success. It’s a comprehensive analysis that assesses the viability of a project or venture, helping you make informed decisions that can shape the future of your enterprise.

What is a Feasibility Study?

A feasibility study is an in-depth examination of a proposed project, meticulously evaluating its potential. It seeks to answer the fundamental question: is this project worth pursuing?

Through a systematic review of costs, benefits, risks, and potential outcomes, a feasibility study provides a roadmap for making smart investments. It’s a blueprint for financial success, ensuring that your resources are channeled into projects with the highest likelihood of yielding positive results.

Economic Feasibility: The Key to Assessing Project Viability

When embarking on a new business venture or investment, economic feasibility is paramount. It’s the cornerstone that helps you determine the financial viability of your project and assess its potential for success.

Cost-Benefit Analysis

At the heart of economic feasibility lies cost-benefit analysis. It’s a systematic process that compares the total costs of a project to its expected benefits. By quantifying both the financial and non-financial impacts, you can make an informed decision about whether the project is worth pursuing.

Return on Investment (ROI)

Another crucial metric for economic feasibility is ROI. ROI measures the financial return you expect to receive from your investment compared to the costs incurred. A positive ROI indicates that the project is financially viable, while a negative ROI suggests that it may not be a wise investment.

Viability Assessment

Once you have conducted a cost-benefit analysis and calculated the ROI, it’s time for a viability assessment. This involves evaluating the project’s financial projections, market conditions, and competitive landscape. By carefully considering all these factors, you can determine whether the project is likely to succeed and generate a positive return.

So, if you’re looking to make a sound investment decision, economic feasibility is your guiding light. By carefully evaluating costs, benefits, and ROI, you can confidently assess the viability of your project and increase your chances of financial success.

Financial Feasibility: Evaluating Cash Flow and Funding Sources

When assessing a project’s financial viability, an integral step is conducting a financial feasibility study. This analysis scrutinizes the project’s cash flow, capital structure, and investment appraisal to determine its financial soundness and sustainability.

Cash Flow Analysis:

A cash flow analysis evaluates the project’s ability to generate positive cash flow, ensuring that it can cover its operating expenses, debt repayments, and expansion plans. This analysis involves forecasting the project’s cash inflows (revenue) and outflows (expenditures) over its lifetime.

Capital Structure:

The capital structure of a project refers to the mix of debt and equity financing used to fund the project. A sound capital structure balances the need for funding with the associated costs of debt. The analysis assesses the optimal ratio of debt to equity, considering factors such as the project’s risk profile and the cost of capital.

Investment Appraisal:

Investment appraisal techniques, such as net present value (NPV) and internal rate of return (IRR), are employed to evaluate the project’s expected return on investment. NPV measures the present value of the project’s future cash flows, while IRR calculates the discount rate that equates the project’s NPV to zero. These techniques help determine the project’s profitability and attractiveness for potential investors.

By thoroughly evaluating these financial aspects, a financial feasibility study provides a comprehensive assessment of the project’s financial viability and its ability to generate sufficient cash flow to support its operations and achieve its financial objectives.

Fixed Costs: The Bedrock of Business Operations

Every business incurs expenses that remain relatively constant regardless of activity levels. These expenses form the backbone of any enterprise’s financial structure and are known as fixed costs. Understanding fixed costs is crucial for determining profitability and making informed decisions.

Depreciation is one such fixed cost. It represents the gradual decline in an asset’s value over time. Imagine purchasing a delivery van for your business. As the van ages, its value depreciates, reflecting its reduced efficiency and market worth. This depreciation is recognized as a fixed expense in your financial statements.

Rent is another common fixed cost. Whether you rent office space, a warehouse, or a storefront, this expense remains the same regardless of how busy your business is on any given day. It’s an essential cost for housing your operations and maintaining a presence in a particular location.

Finally, salaries represent a significant portion of fixed costs. Employee compensation, including wages, benefits, and bonuses, remains relatively stable, regardless of fluctuations in sales or production levels. Paying your team a fair wage ensures a motivated and productive workforce, which is indispensable for long-term success.

The impact of fixed costs on profitability is profound. They represent a substantial portion of a business’s operating expenses, which must be covered before profits can be realized. Consequently, managing fixed costs effectively is essential for maintaining financial health and maximizing returns.

Operating Costs: The Foundation of Business Operations

Like the steady heartbeat that keeps a business alive, operating costs are the essential expenses that ensure the day-to-day functioning of an enterprise. These costs, often referred to as overhead expenses, are distinct from fixed costs, which remain constant regardless of production volume, and variable costs, which fluctuate with output.

Operating costs encompass a wide range of expenses that are crucial for keeping the business running smoothly. These include:

- Insurance: Protecting the business from unexpected events, such as fires, theft, or lawsuits.

- Utilities: Essential services like electricity, water, and gas, which power the business’s operations.

- Wages: Compensation for employees’ work, a major expense that contributes to the business’s success.

These costs are closely intertwined with business operations. Insurance ensures that the business can recover from unforeseen events, minimizing disruptions and financial losses. Utilities provide the lifeblood for production processes, ensuring efficient and uninterrupted operations. Wages, the foundation of any business, compensate employees for their contributions and drive productivity.

Understanding and managing operating costs is paramount for business success. By carefully analyzing these expenses, businesses can identify areas for cost optimization without compromising operational efficiency. This analysis can help maximize profitability and ensure the long-term sustainability of the enterprise.

Production Costs: The Core Expenses of Manufacturing

At the heart of any manufacturing process lies the concept of production costs, the expenses incurred in transforming raw materials into finished products. Understanding these costs is crucial for businesses to assess their profitability, optimize operations, and ensure financial success.

Direct Material: The Raw Essence of Products

Direct material costs encompass the tangible materials that are physically incorporated into the final product. These costs include the purchase price of raw materials, such as steel, plastic, or fabric, as well as any associated transportation and handling charges. Careful selection and negotiation with suppliers can significantly impact a company’s profitability.

Direct Labor: The Human Touch in Production

Direct labor costs represent the wages paid to production workers directly involved in the manufacturing process. These workers contribute their skills and expertise to convert raw materials into finished products. Managing labor costs effectively involves balancing productivity with employee compensation and benefits.

Overhead: The Hidden Costs of Manufacturing

Overhead costs, unlike direct material and labor costs, are indirect expenses that support the production process but cannot be directly attributed to a specific unit of output. These costs include rent, utilities, depreciation of machinery, and salaries of administrative and supervisory personnel. Managing overhead costs efficiently requires a comprehensive understanding of their drivers and optimizing their allocation to minimize waste and improve profitability.

By thoroughly analyzing direct material, direct labor, and overhead costs, manufacturers can gain invaluable insights into their production processes. This knowledge empowers them to identify areas for cost reduction, improve efficiency, and ultimately enhance their financial performance. With meticulous cost management, businesses can create a solid foundation for sustainable growth and profitability.

Profitability Analysis: Measuring Financial Success

Understanding your business’s profitability is crucial for long-term financial stability. Profitability analysis assesses how effectively your company generates revenue compared to its expenses. By measuring key metrics, you can identify areas for improvement and make informed decisions to enhance your bottom line.

Key Profitability Metrics

Gross Margin: This metric measures how much profit your business makes on each dollar of sales. It’s calculated by dividing gross profit by total sales revenue. A higher gross margin indicates that your business is able to cover its fixed and variable costs more efficiently.

Net Income: Net income represents the true profit your business has made after subtracting all expenses and taxes. It’s calculated by deducting operating expenses, interest expenses, and taxes from gross profit. A positive net income indicates that your business is profitable, while a negative net income suggests you’re operating at a loss.

Return on Sales (ROS): This metric measures how much net income your business generates for each dollar of sales revenue. It’s calculated by dividing net income by total sales revenue. A higher ROS indicates that your business is operating efficiently and generating a strong profit margin.

By analyzing these key metrics, you can assess your business’s profitability, identify strengths and weaknesses, and develop strategies to improve your bottom line. Profitability analysis is an essential tool for any business seeking to maximize revenue and ensure long-term financial success.

Sustainable Cost Considerations: Balancing Profitability with Responsibility

In today’s rapidly evolving business landscape, companies are increasingly recognizing the crucial need to balance their pursuit of profitability with a deep commitment to environmental and social responsibility. Sustainable cost considerations have emerged as a critical element in this equation, challenging businesses to minimize their impact on the planet while maximizing their bottom line.

Environmental stewardship has become an imperative for businesses, with consumers and investors demanding accountability for their environmental footprint. Companies that prioritize reducing their carbon emissions, conserving natural resources, and minimizing waste are not only doing the right thing but also gaining a competitive edge in the marketplace.

Social responsibility encompasses a wide range of concerns, including fair labor practices, community engagement, and ethical sourcing. Businesses that embrace these values can foster a positive work environment, build strong relationships with stakeholders, and enhance their brand reputation.

Integrating sustainability into cost considerations can unlock significant business opportunities. By implementing energy-efficient processes, reducing raw material consumption, and adopting sustainable supply chains, companies can lower their operating costs while simultaneously demonstrating their commitment to the environment and society.

However, striking the right balance between profitability and sustainability can be a challenging endeavor. It requires a holistic approach that considers both short-term financial gains and long-term ethical considerations. By investing in sustainable initiatives, companies can secure their future, attract ethical consumers, and ultimately create a positive impact on the world around them.

Total Cost: A Comprehensive View of Expenses

Understanding the total cost of a business is crucial for evaluating its financial health and making informed decisions. It encompasses all expenses associated with running a business, providing a clear picture of its overall financial position.

Two key indicators of financial position are the break-even point and cost of production. The break-even point represents the level of production or sales at which the business generates neither profit nor loss. It is calculated by dividing fixed costs by the contribution margin, which is the difference between selling price and variable costs.

The cost of production, on the other hand, includes all expenses directly related to the creation of goods or services. It consists of direct material, direct labor, and overhead costs. Understanding these components allows businesses to optimize production processes and minimize costs.

By comprehensively calculating total cost, businesses can assess their overall financial performance, identify areas for cost reduction, and make informed choices that contribute to long-term profitability.

Variable Costs: The Fluctuating Expenses of Production

In the intricate tapestry of business finances, variable costs emerge as the dynamic companions to fixed costs, dancing to the rhythm of production volume. Unlike their fixed counterparts, these expenses gracefully adapt to the ebb and flow of your output.

Commission, the enticing reward for sales prowess, stands as a prime example of variable costs. As the number of goods or services sold increases, so too does the commission earned. This intertwined relationship mirrors the growth of your business, reflecting the direct correlation between sales volume and compensation.

Raw materials, the lifeblood of manufacturing, also fall under the umbrella of variable costs. Every widget, gadget, or garment requires an infusion of raw materials to take shape. As production ramps up, the demand for these materials inevitably rises, impacting your overall expenses.

Utilities, the hidden maestros of business operations, quietly contribute to the variable cost equation. The more your facilities hum with activity, the more energy and water are consumed. This direct relationship between production volume and utility consumption underscores the dynamic nature of these expenses.

memahami hubungan antara biaya variabel dan volume produksi sangat penting untuk navigasi keuangan yang efektif. Biaya variabel dapat memberikan wawasan tentang titik impas, di mana pendapatan sama dengan biaya produksi. Memahami bagaimana biaya variabel berfluktuasi memungkinkan Anda memproyeksikan pengeluaran masa depan, mengoptimalkan proses produksi, dan memaksimalkan keuntungan.